United Kingdom Sotheby’s International Realty Achieves Highest Price-Per-Square-Foot in Mayfair in 2025

United Kingdom Sotheby's International Realty has closed a landmark deal in Mount Row, one of Mayfair's most coveted addresses – an immaculate three-bedroom turnkey townhouse guided at £12.95 million, securing the highest price per square foot in the area as of December 2024. The transaction was expertly orchestrated by Senior Sales Directors Simon Burgoyne and James Gubbins, who sold the property to an international buyer of Italian and Swiss heritage, who was drawn to the distinct lifestyle offering of Mayfair. The exchange took place a week before the announcement of the contentious Autumn Budget, reflecting the resilience of the capital's prime property sector amid broader economic headwinds.

The Property

Tucked onto the prestigious Mount Row, this exceptional townhouse embodies effortless luxury at every turn. Light floods through multiple skylights into a bespoke kitchen of custom wooden cabinetry, sleek stone surfaces, and top-tier Miele appliances, while the principal reception opens onto a sun-drenched south-facing terrace with high ceilings, warm parquet, and a sophisticated palette.

The principal suite is a study in indulgence: generous proportions, a walk-in wardrobe, and a spa-like ensuite that feels worlds away. Two additional double bedrooms, each with beautifully finished ensuites, provide gracious space without compromise. Every detail speaks to quality, every finish impeccably executed. Secure parking, a grand home cinema, and a separate utility complete the picture of considered modern living.

Commenting on the success of this sale, Gubbins explained, "This sale is a textbook example of how best-in-class properties will always achieve a strong price. There's a limited stock of turnkey homes on the market, so premium pricing can be achieved. Buyers love the idea of purchasing something that's ready to use, saving time and jumping over the hurdles of renovation – particularly given current interest rates and stamp duty costs."

The Market

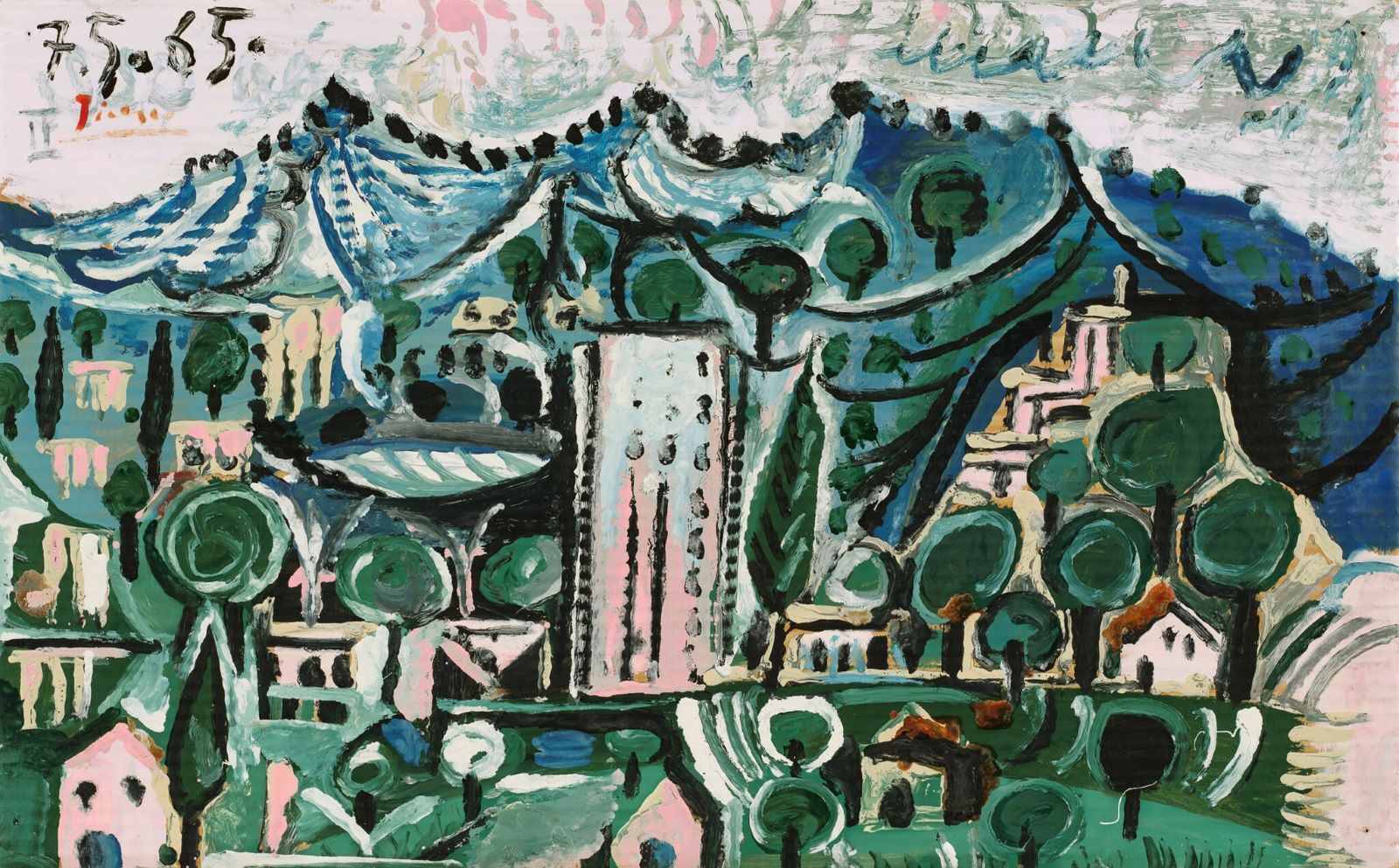

This sale exemplifies the enduring appeal of Mayfair – and London's premier neighbourhoods at large – given that the sale was motivated by genuine admiration for the area's unique lifestyle offering, characterised by its designer boutiques, five-star restaurants, private clubs and galleries.

More significantly, it underscores the resilience of London's ultra-luxury real estate sector. While the market was reportedly rattled by rumours of wealth taxes in the upcoming Budget and was still absorbing the shocks of the previous Budget, which announced the non-dom regime abolition and significant stamp duty hikes, undeterred buyers continued to transact. This purchaser's appreciation for Mayfair clearly transcended short-term fiscal concerns, reflecting a longstanding trend among international high-net-worth individuals who view London as a safe haven to put down roots and preserve investment portfolios.

According to our 2025 performance analysis, Mayfair led in sales transaction volume, attracting a diverse buyer base: international high-net-worth individuals seeking trophy assets, affluent professionals, and buyers relocating from rural areas of the UK including Cheshire. International purchasers hailed from the UAE, GCC, India, Europe, the United States, and now increasingly, South America.

Burgoyne noted, “Mayfair's appeal is driven by scarcity paired with ongoing regeneration. Prime residential supply is at a 10-year low, yet 2024 sales volumes were the highest in a decade, creating natural competition for the best stock. At the same time, you've got landmark schemes like 1 Mayfair and the £4 billion makeover through the Piccadilly Estate, Caudwell, and others, putting Mayfair back at the top of the Monopoly board, so to speak.”

He summarised, "The combination of limited top-tier homes, plus world-class hotels, restaurants, and culture, makes Mayfair feel like a 24-hour, best-in-class lifestyle district.”

Final Thoughts

This sale is reflective of the resilience demonstrated by London's prime property sector in 2025. Despite headwinds, internal market data showed that sales across the residential and investment portfolios continued to perform commendably, with 95% of the average guide price being achieved, evidencing strong market confidence. Mayfair's strength is defined by its rich heritage and limited supply of ultra-prime stock, leading to sustained price stability and competitive bidding.

The fundamental drivers that defined PCL's landscape in 2025's uncertain climate will continue to prevail. Mayfair's exclusivity, paired with the ongoing regeneration in the area, positions the neighbourhood as a premier destination for discerning investors in 2026.

This transaction also highlights the seasoned expertise of our specialists. Notwithstanding the negative sentiment weighing on the market, our advisory team was able to capitalise on what made Mayfair uniquely resilient in the uncertain landscape. We were able to seize the enduring domestic and global strength of the capital, position the area as a safe domicile for wealth, and execute a successful transaction that exceeded client expectations.

Alex Isidro, Managing Director, United Kingdom Sotheby’s International Realty, commented, “We own the Mayfair market, and this sale proves it. Simon and James have done an excellent job, and we're off to a great start in 2026.”